All Categories

Featured

Table of Contents

Note, nonetheless, that this doesn't claim anything concerning adjusting for inflation. On the bonus side, also if you assume your choice would be to invest in the stock exchange for those 7 years, and that you would certainly get a 10 percent yearly return (which is much from certain, specifically in the coming years), this $8208 a year would be greater than 4 percent of the resulting small stock value.

Example of a single-premium deferred annuity (with a 25-year deferment), with four settlement choices. Courtesy Charles Schwab. The monthly payment here is highest possible for the "joint-life-only" choice, at $1258 (164 percent more than with the immediate annuity). The "joint-life-with-cash-refund" choice pays out just $7/month much less, and assurances at least $100,000 will certainly be paid out.

The method you get the annuity will identify the solution to that question. If you get an annuity with pre-tax dollars, your costs lowers your gross income for that year. Nevertheless, eventual payments (month-to-month and/or swelling amount) are taxed as routine income in the year they're paid. The advantage right here is that the annuity might let you defer taxes past the internal revenue service contribution restrictions on Individual retirement accounts and 401(k) plans.

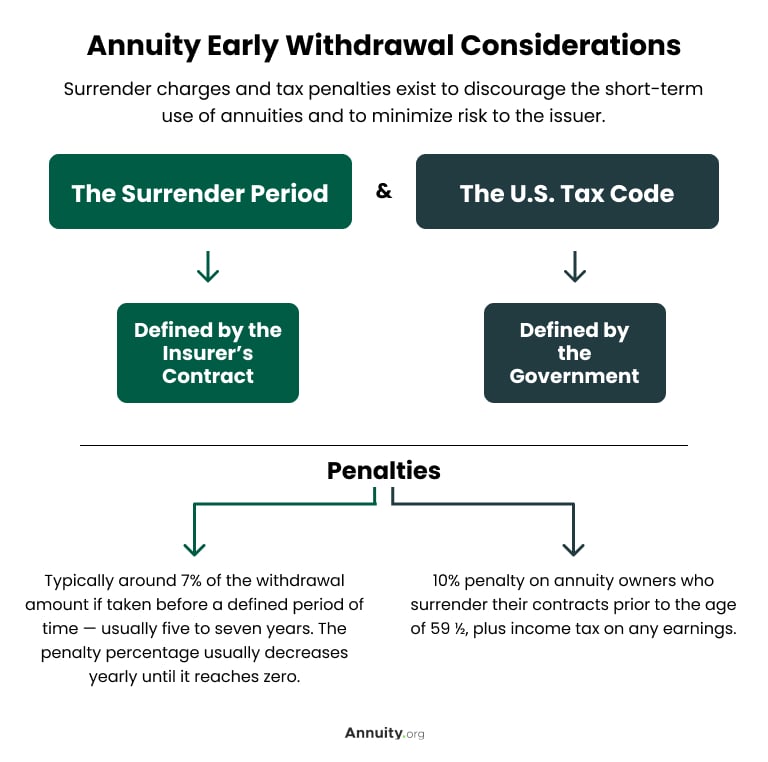

According to , purchasing an annuity inside a Roth plan results in tax-free payments. Getting an annuity with after-tax dollars outside of a Roth results in paying no tax on the part of each payment credited to the initial premium(s), yet the staying portion is taxed. If you're establishing an annuity that starts paying before you're 59 years old, you may have to pay 10 percent early withdrawal fines to the internal revenue service.

How can an Fixed Annuities protect my retirement?

The expert's primary step was to develop a detailed monetary prepare for you, and after that explain (a) how the suggested annuity fits into your total plan, (b) what options s/he thought about, and (c) exactly how such alternatives would or would certainly not have caused reduced or greater compensation for the expert, and (d) why the annuity is the exceptional option for you. - Flexible premium annuities

Naturally, an expert may try pushing annuities even if they're not the very best fit for your circumstance and objectives. The reason could be as benign as it is the only item they sell, so they fall prey to the typical, "If all you have in your toolbox is a hammer, quite quickly everything starts resembling a nail." While the advisor in this situation might not be underhanded, it raises the danger that an annuity is a poor option for you.

How can an Fixed-term Annuities protect my retirement?

Considering that annuities commonly pay the agent offering them a lot greater commissions than what s/he would certainly get for spending your cash in shared funds - Flexible premium annuities, not to mention the zero compensations s/he 'd obtain if you spend in no-load mutual funds, there is a huge reward for agents to press annuities, and the a lot more complicated the far better ()

A deceitful consultant suggests rolling that quantity right into new "far better" funds that simply take place to bring a 4 percent sales load. Consent to this, and the expert pockets $20,000 of your $500,000, and the funds aren't likely to execute far better (unless you selected a lot more badly to start with). In the very same example, the consultant might guide you to get a difficult annuity with that $500,000, one that pays him or her an 8 percent compensation.

The expert hasn't figured out how annuity repayments will be tired. The consultant hasn't divulged his/her payment and/or the fees you'll be charged and/or hasn't shown you the impact of those on your eventual repayments, and/or the payment and/or charges are unacceptably high.

Your household history and current wellness point to a lower-than-average life span (Tax-deferred annuities). Current rate of interest, and hence projected settlements, are historically reduced. Even if an annuity is ideal for you, do your due diligence in contrasting annuities offered by brokers vs. no-load ones marketed by the releasing business. The latter may need you to do even more of your own research, or make use of a fee-based financial consultant that might get compensation for sending you to the annuity provider, however may not be paid a greater payment than for other investment options.

What does an Variable Annuities include?

The stream of monthly repayments from Social Safety is similar to those of a postponed annuity. Since annuities are voluntary, the individuals acquiring them normally self-select as having a longer-than-average life expectancy.

Social Safety and security benefits are fully indexed to the CPI, while annuities either have no rising cost of living defense or at a lot of supply a set percent annual boost that might or may not make up for inflation completely. This sort of cyclist, similar to anything else that boosts the insurer's risk, needs you to pay more for the annuity, or approve lower repayments.

Flexible Premium Annuities

Disclaimer: This post is intended for informative purposes only, and must not be considered economic guidance. You ought to speak with a monetary specialist before making any type of significant economic choices.

Considering that annuities are meant for retirement, taxes and charges may apply. Principal Defense of Fixed Annuities. Never lose principal because of market efficiency as fixed annuities are not purchased the market. Also during market slumps, your cash will certainly not be affected and you will certainly not lose money. Diverse Investment Options.

Immediate annuities. Deferred annuities: For those who want to grow their money over time, yet are prepared to postpone accessibility to the cash till retirement years.

What are the benefits of having an Fixed Vs Variable Annuities?

Variable annuities: Offers better potential for development by investing your cash in investment choices you pick and the ability to rebalance your portfolio based on your preferences and in such a way that aligns with changing monetary objectives. With taken care of annuities, the company spends the funds and supplies a passion price to the client.

When a death claim happens with an annuity, it is necessary to have a named recipient in the agreement. Different options exist for annuity survivor benefit, relying on the agreement and insurance firm. Choosing a refund or "duration certain" choice in your annuity offers a death advantage if you die early.

How can an Secure Annuities help me with estate planning?

Calling a recipient various other than the estate can help this procedure go extra smoothly, and can aid ensure that the proceeds go to whoever the private desired the money to go to rather than going with probate. When existing, a fatality advantage is automatically consisted of with your contract.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Defining the Right Financial Strategy Features of Retirement Income Fixed Vs Variable Annuity Why Choosing the Right Finan

Breaking Down Your Investment Choices Key Insights on Your Financial Future What Is Fixed Income Annuity Vs Variable Growth Annuity? Pros and Cons of Fixed Income Annuity Vs Variable Growth Annuity Wh

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices Defining Variable Annuities Vs Fixed Annuities Advantages and Disadvantages of Fixed Annuity Vs Equit

More

Latest Posts