All Categories

Featured

Table of Contents

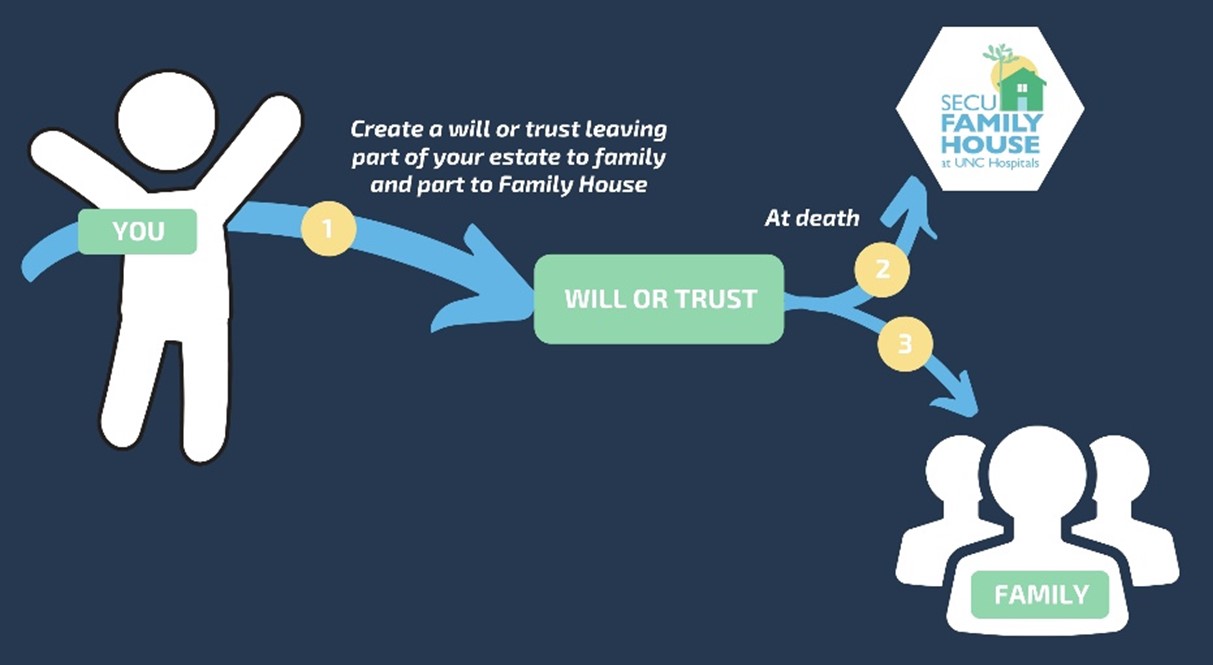

On the other hand, if a customer needs to offer an unique needs youngster who might not be able to manage their very own cash, a trust fund can be added as a recipient, enabling the trustee to take care of the circulations. The type of recipient an annuity proprietor selects affects what the beneficiary can do with their inherited annuity and exactly how the profits will be tired.

Numerous contracts permit a spouse to determine what to do with the annuity after the owner passes away. A spouse can alter the annuity agreement right into their name, thinking all regulations and rights to the first contract and postponing instant tax effects (Annuities for retirement planning). They can collect all remaining repayments and any kind of survivor benefit and pick beneficiaries

When a spouse ends up being the annuitant, the spouse takes over the stream of payments. Joint and survivor annuities likewise enable a called recipient to take over the agreement in a stream of payments, instead than a swelling amount.

A non-spouse can only access the marked funds from the annuity owner's preliminary arrangement. In estate preparation, a "non-designated beneficiary" describes a non-person entity that can still be named a beneficiary. These consist of counts on, charities and various other organizations. Annuity proprietors can choose to designate a trust fund as their beneficiary.

What is the difference between an Annuity Payout Options and other retirement accounts?

These differences designate which recipient will certainly receive the entire survivor benefit. If the annuity proprietor or annuitant dies and the main recipient is still alive, the key recipient gets the death benefit. However, if the main beneficiary predeceases the annuity owner or annuitant, the death advantage will go to the contingent annuitant when the proprietor or annuitant passes away.

The owner can transform beneficiaries any time, as long as the agreement does not call for an unalterable recipient to be named. According to professional contributor, Aamir M. Chalisa, "it is necessary to recognize the significance of assigning a beneficiary, as picking the incorrect recipient can have major repercussions. A lot of our clients pick to name their underage kids as beneficiaries, typically as the primary beneficiaries in the absence of a partner.

Owners who are wed must not presume their annuity immediately passes to their partner. Usually, they go via probate. Our brief test gives clarity on whether an annuity is a clever selection for your retirement profile. When picking a recipient, take into consideration elements such as your connection with the person, their age and exactly how inheriting your annuity might impact their financial scenario.

The beneficiary's connection to the annuitant typically establishes the rules they follow. A spousal beneficiary has even more choices for dealing with an inherited annuity and is treated even more leniently with tax than a non-spouse beneficiary, such as a youngster or other family members member. Expect the proprietor does make a decision to name a kid or grandchild as a beneficiary to their annuity

Who should consider buying an Annuity Income?

In estate planning, a per stirpes designation specifies that, should your beneficiary pass away prior to you do, the recipient's offspring (kids, grandchildren, and so on) will receive the fatality benefit. Get in touch with an annuity specialist. After you have actually chosen and named your recipient or recipients, you need to continue to review your options a minimum of yearly.

Maintaining your designations up to day can guarantee that your annuity will be dealt with according to your dreams must you pass away all of a sudden. A yearly evaluation, significant life occasions can trigger annuity proprietors to take an additional look at their beneficiary options.

Who should consider buying an Guaranteed Income Annuities?

Just like any type of economic item, seeking the help of a monetary advisor can be valuable. A financial coordinator can lead you via annuity administration processes, consisting of the approaches for upgrading your agreement's recipient. If no beneficiary is named, the payout of an annuity's death advantage goes to the estate of the annuity owner.

To make Wealthtender complimentary for visitors, we earn money from advertisers, consisting of financial professionals and companies that pay to be featured. This creates a dispute of rate of interest when we favor their promo over others. Wealthtender is not a client of these monetary services service providers.

As a writer, it is among the best praises you can offer me. And though I truly value any one of you investing several of your hectic days reviewing what I create, clapping for my short article, and/or leaving appreciation in a comment, asking me to cover a topic for you genuinely makes my day.

It's you claiming you trust me to cover a subject that is essential for you, which you're confident I 'd do so better than what you can already discover on the internet. Pretty heady stuff, and a duty I do not take likely. If I'm not accustomed to the topic, I investigate it on the internet and/or with calls who recognize even more regarding it than I do.

Lifetime Income Annuities

In my close friend's case, she was assuming it would be an insurance coverage of types if she ever before goes right into nursing home care. Can you cover annuities in a write-up?" Are annuities a valid recommendation, a wise step to safeguard surefire income for life? Or are they an underhanded advisor's means of fleecing unsuspecting customers by convincing them to relocate possessions from their portfolio right into a complicated insurance policy item tormented by extreme charges? In the simplest terms, an annuity is an insurance product (that just certified representatives may market) that ensures you regular monthly settlements.

Exactly how high is the surrender charge, and the length of time does it use? This usually relates to variable annuities. The more motorcyclists you add, and the less threat you agree to take, the lower the settlements you must expect to get for a given costs. The insurer isn't doing this to take a loss (however, a little bit like a casino, they're ready to lose on some customers, as long as they more than make up for it in greater profits on others).

How can an Lifetime Payout Annuities protect my retirement?

Annuities picked properly are the ideal option for some individuals in some conditions., and after that number out if any annuity option offers sufficient advantages to validate the prices. I made use of the calculator on 5/26/2022 to see what an instant annuity might payout for a solitary premium of $100,000 when the insured and partner are both 60 and live in Maryland.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Defining the Right Financial Strategy Features of Retirement Income Fixed Vs Variable Annuity Why Choosing the Right Finan

Breaking Down Your Investment Choices Key Insights on Your Financial Future What Is Fixed Income Annuity Vs Variable Growth Annuity? Pros and Cons of Fixed Income Annuity Vs Variable Growth Annuity Wh

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices Defining Variable Annuities Vs Fixed Annuities Advantages and Disadvantages of Fixed Annuity Vs Equit

More

Latest Posts